G.P.S (Green Policy-Analyzer System)

Shin Kong Life Insurance Co., Ltd.

G.P.S (Green Policy-Analyzer System)

Shin Kong Life Insurance Co., Ltd.

Back to Hall of Fame

Back to Hall of Fame

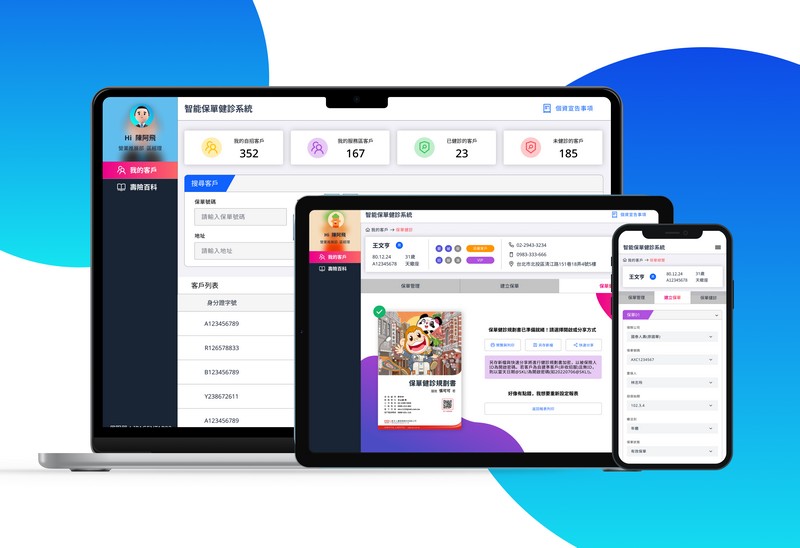

Policy Gap Analysis is the cornerstone of insurance services. Traditionally, agents manually input data, which takes several days or even weeks to analyze and compile into a comprehensible Policy Diagnosis and Planning Guide for presentation to policyholders. To streamline this, Shin Kong Life Insurance has implemented the “Green Policy-Analyzer System” to provide agents with high-efficiency digital tools.

This includes using the Optical Character Recognition (OCR) and Natural Language Processing (NLP) technologies to replace manual data entry and filing. Agents can now photograph policies from various insurance companies and use AI to analyze them. This allows them to consolidate the existing policy coverage overview within minutes, significantly improving service efficiency.

The resulting Policy Gap Analysis Reports are also innovative, covering nine major protection items: accident, death, cancer, long-term care, critical illness, fixed hospitalization medical expenses, actual expenses, lifelong medical care, and critical illness. Additionally, they offer new survival benefits information, assisting agents to more accurately identify protection gaps. This not only improves service efficiency but also enhances reputation and performance by allowing agents to meet policyholders' needs more precisely.

Highlights

- Utilizes Optical Character Recognition (OCR) technology to replace manual filing, automatically extracting content into the corresponding fields.

- Through Natural Language Processing (NLP) and Deep Learning, machines learn to recognize insurance policies.

- With a vast database, it can accurately consolidate the coverage details of insurance products from various companies, enabling the creation of a clear, comprehensive Policy Diagnosis and Planning Guide for clients.

- Offering an online self-service Policy Diagnosis and Planning Guide website, it translates complex insurance jargon into easy-to-read visual graphics. The gamified user experience allows individuals to quickly and effortlessly understand their policies and instantly share the result reports on Facebook and LINE with friends.

View Website

Back to Hall of Fame

Back to Hall of Fame

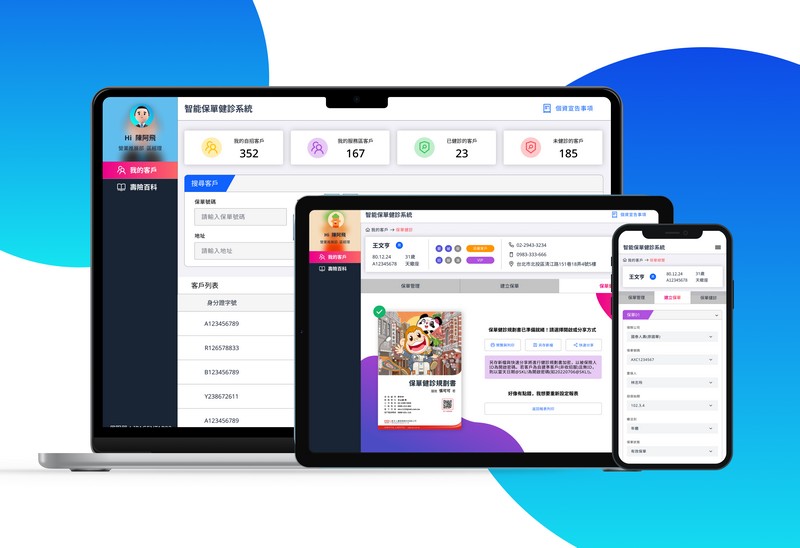

Policy Gap Analysis is the cornerstone of insurance services. Traditionally, agents manually input data, which takes several days or even weeks to analyze and compile into a comprehensible Policy Diagnosis and Planning Guide for presentation to policyholders. To streamline this, Shin Kong Life Insurance has implemented the “Green Policy-Analyzer System” to provide agents with high-efficiency digital tools.

This includes using the Optical Character Recognition (OCR) and Natural Language Processing (NLP) technologies to replace manual data entry and filing. Agents can now photograph policies from various insurance companies and use AI to analyze them. This allows them to consolidate the existing policy coverage overview within minutes, significantly improving service efficiency.

The resulting Policy Gap Analysis Reports are also innovative, covering nine major protection items: accident, death, cancer, long-term care, critical illness, fixed hospitalization medical expenses, actual expenses, lifelong medical care, and critical illness. Additionally, they offer new survival benefits information, assisting agents to more accurately identify protection gaps. This not only improves service efficiency but also enhances reputation and performance by allowing agents to meet policyholders' needs more precisely.

Highlights

- Utilizes Optical Character Recognition (OCR) technology to replace manual filing, automatically extracting content into the corresponding fields.

- Through Natural Language Processing (NLP) and Deep Learning, machines learn to recognize insurance policies.

- With a vast database, it can accurately consolidate the coverage details of insurance products from various companies, enabling the creation of a clear, comprehensive Policy Diagnosis and Planning Guide for clients.

- Offering an online self-service Policy Diagnosis and Planning Guide website, it translates complex insurance jargon into easy-to-read visual graphics. The gamified user experience allows individuals to quickly and effortlessly understand their policies and instantly share the result reports on Facebook and LINE with friends.