MOBILE BANKING APP

BANK SINOPAC

MOBILE BANKING APP

BANK SINOPAC

Back to Hall of Fame

Back to Hall of Fame

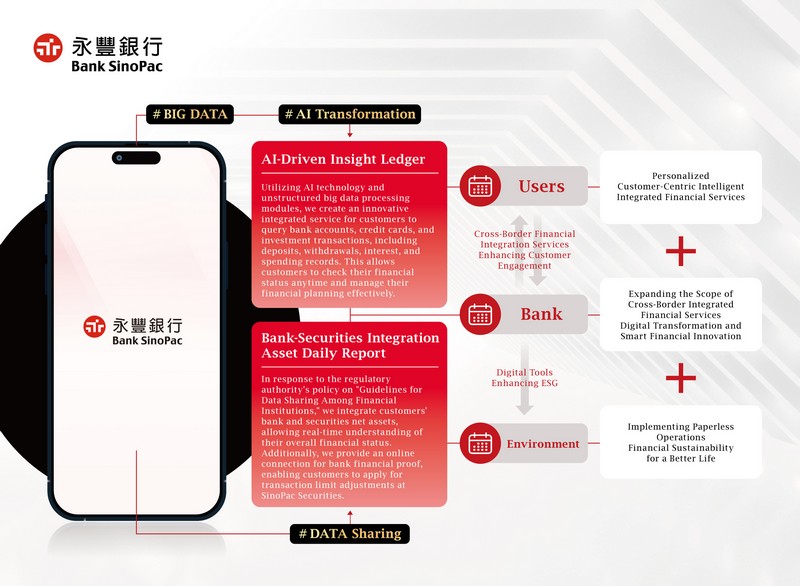

"Transforming Finance, Creating a Better Life Together." This phrase encapsulates the mission, values, and vision of SinoPac Holdings, representing its unwavering commitment to all its stakeholders. By embracing a transformative momentum, SinoPac strives to achieve co-creation between the bank and its customers, as well as among customers themselves, working together to achieve a sustainable and prosperous future with SinoPac.

The Bank SinoPac Mobile Banking APP prioritizes user-centric services and aims to provide convenience for customers. By integrating banking and credit card information, users can effortlessly track their customized financial flows. Designed to cater to the evolving needs of the digital age, the app offers a comprehensive, seamless one-stop service experience, empowering users to manage their assets confidently.

The AI-Driven Insight Ledger service has provided integrated inquiries of bank account deposits and credit card consumption details for over a decade. It is not limited to a single inquiry range; users can analyze and calculate income and expenditure in real-time. Additionally, statistics enables customers to easily understand their financial status and empower them to edit transaction categories and notes.

Bank-Securities Integration Asset Daily Report consolidates data from various subsidiaries under Bank SinoPac, including foreign currency deposits, funds, bonds, ibrAin, domestic and overseas securities, loans, and credit card transactions. It also provides customers with a detailed overview of their "Bank Assets" and "Securities Assets" with visualized charts that illustrate asset allocation.

Highlights

- The mobile banking app is a personalized intelligent asset management that enables customers to track and analyze transactions efficiently with intelligent labeling and customized charts through the "AI-Driven Insight Ledger" service.

- The Mobile Banking APP offers Cross-Border Integrated Financial Services and its Bank-Securities Integration Asset Daily Report provides a unified view of banking and securities assets.

- The Mobile Banking APP now offers the "Bank-Securities Integration Asset Daily Report," giving customers a comprehensive view of their assets across Bank SinoPac and SinoPac Securities. Such digitalize over-the-counter processes, reducing the need for paper statements and carbon emissions by 720 kilograms monthly.

View Website

Back to Hall of Fame

Back to Hall of Fame

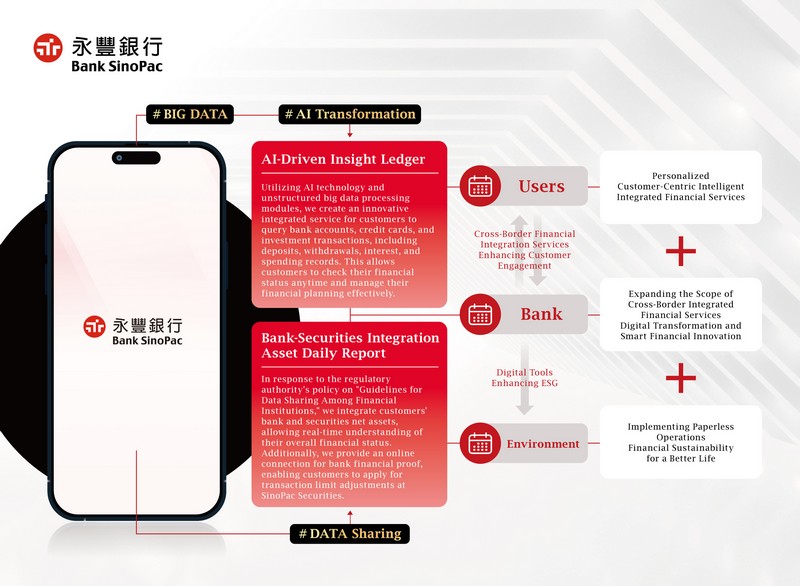

"Transforming Finance, Creating a Better Life Together." This phrase encapsulates the mission, values, and vision of SinoPac Holdings, representing its unwavering commitment to all its stakeholders. By embracing a transformative momentum, SinoPac strives to achieve co-creation between the bank and its customers, as well as among customers themselves, working together to achieve a sustainable and prosperous future with SinoPac.

The Bank SinoPac Mobile Banking APP prioritizes user-centric services and aims to provide convenience for customers. By integrating banking and credit card information, users can effortlessly track their customized financial flows. Designed to cater to the evolving needs of the digital age, the app offers a comprehensive, seamless one-stop service experience, empowering users to manage their assets confidently.

The AI-Driven Insight Ledger service has provided integrated inquiries of bank account deposits and credit card consumption details for over a decade. It is not limited to a single inquiry range; users can analyze and calculate income and expenditure in real-time. Additionally, statistics enables customers to easily understand their financial status and empower them to edit transaction categories and notes.

Bank-Securities Integration Asset Daily Report consolidates data from various subsidiaries under Bank SinoPac, including foreign currency deposits, funds, bonds, ibrAin, domestic and overseas securities, loans, and credit card transactions. It also provides customers with a detailed overview of their "Bank Assets" and "Securities Assets" with visualized charts that illustrate asset allocation.

Highlights

- The mobile banking app is a personalized intelligent asset management that enables customers to track and analyze transactions efficiently with intelligent labeling and customized charts through the "AI-Driven Insight Ledger" service.

- The Mobile Banking APP offers Cross-Border Integrated Financial Services and its Bank-Securities Integration Asset Daily Report provides a unified view of banking and securities assets.

- The Mobile Banking APP now offers the "Bank-Securities Integration Asset Daily Report," giving customers a comprehensive view of their assets across Bank SinoPac and SinoPac Securities. Such digitalize over-the-counter processes, reducing the need for paper statements and carbon emissions by 720 kilograms monthly.